The Challenge

With this new rapid growth, the Digital Banking App faced a dilemma: its arsenal of tools didn’t align with its go-to-market strategy. It was a classic case of falling into the “Frankenstein trap” - a patchwork of disjointed solutions and data that hindered efficiency. They needed a cohesive plan to streamline operations and drive optimal customer experiences.

Fragmented Information Limited Scalability

To help their customers where and when needed, the Digital Banking App developed an omni-channel presence for marketing, service, and sales activities.

But, their current approach to customer support wasn’t scalable.

Queries came in from various channels - social media channels, WhatsApp, telephone, email and live chat - and there was no single source of truth. Support managers were looking at too many tools to compile a complete view of the customer.

When handling live queries, there was no background information to reference and tying the customer’s record to their banking details also proved time-consuming.

It was taking 5-6X times longer to handle a query than desired.

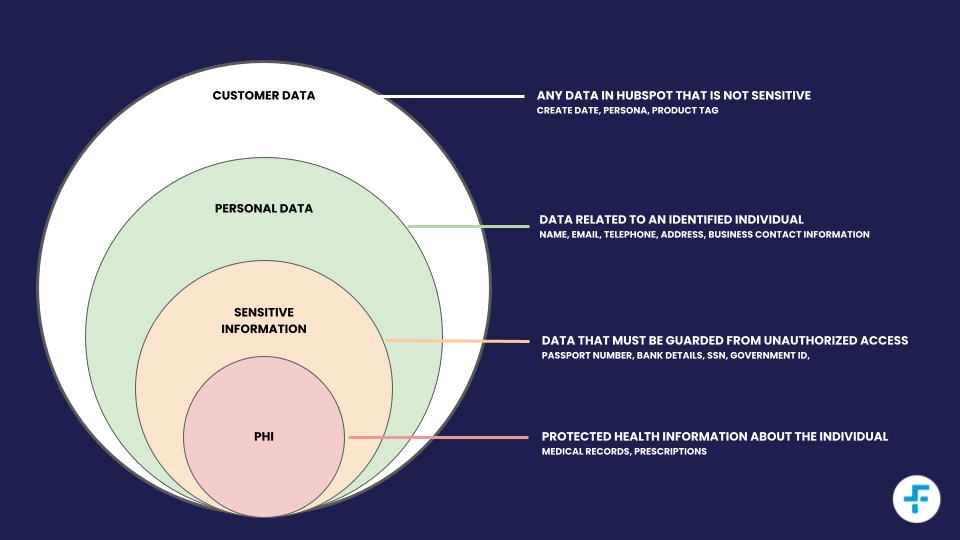

Sensitive Data Handling

Part of the need to view a single source of truth in HubSpot also meant showcasing sensitive data. They needed to ensure that customer support agents had access to data such as transaction statuses and account issues.

Similar to most CRMs, HubSpot does not allow customers to store various types of information that it deems sensitive. Information like credit or debit card numbers, financial account numbers, and more can not be processed and held inside HubSpot.

But for the Digital Banking App to solve customer issues faster, they needed a way to access this information from a central platform without processing the data in HubSpot. This was further complicated due to the legal jurisdictions with regards to data sovereignty. We had to find a solution that enabled the data to be accessed from multiple secure locations whilst ensuring that it was held within the physical borders of the company’s nation state.

Data Security

Ensuring the security of the Digital Banking App’s data was a top priority throughout the implementation process. The approach employed safeguards to protect their data at every stage.

Data was safeguarded during transit, with no storage on the platform and automatic removal from intermediary systems.

Compliance with SOC2, HIPAA, CCPA, and GDPR was ensured, with encrypted data storage and retention for 30 days. Transport Layer Security (TLS) protects data in transit, and encryption algorithms secure stored data.

These measures maintained the confidentiality and integrity of their data, providing peace of mind throughout the implementation.

The Solution

Creating a connected business was a core reason HubSpot was chosen as their single source of truth within their tech stack.

To materialise their goals, we initiated a data mapping and CRM workshop as the first step. During this session, we mapped their current processes, identified challenges and goals, and reviewed automation objectives.

Data Processes

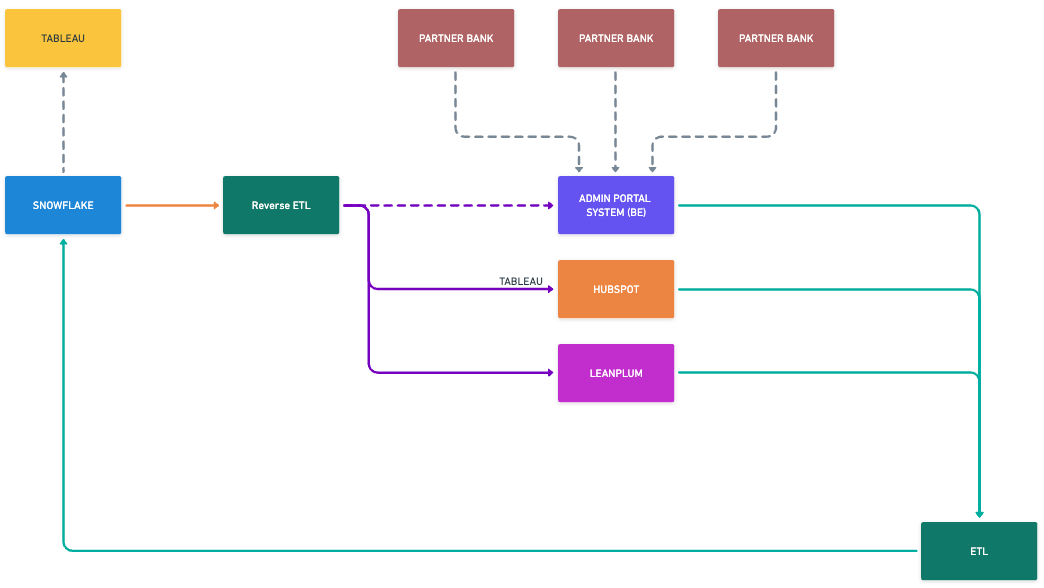

The result was a future-proof data strategy that unified information into a user-friendly format usable across multiple business units.

During the data mapping workshop, we established clear definitions, removed unnecessary properties, and introduced streamlined data structures.

Data flexibility was improved using a data warehouse and implementing connectors for ETL (extract, transform, load) and reverse-ETL processes. This allowed for a seamless transition from custom systems and enabled analysis of HubSpot data using Tableau.

The HubSpot Implementation

The implementation began after mapping properties across the Digital Banking App’s tech stack. As part of this process, the contact centre was designated as the central hub for customer interactions, encompassing various channels such as contacts, voice calls, emails, and texts. The data gathered from the contact centre, along with the customised on-premise database and CMS (Content Management System), seamlessly integrated with HubSpot.

Service Hub equipped them with automated and efficient customer management tools. They could swiftly handle inquiries, offer self-service options, and gather valuable customer feedback.

The HubSpot CRM supported the implementation, providing real-time insights into different aspects of their business. With built-in reporting and dashboards, they could easily visualise and track progress.

Showing Sensitive Data in HubSpot

To showcase sensitive data in HubSpot while remaining compliant, we used iFrames.

iFrames fetched from the Digital Banking Apps’ Data Warehouse and temporarily held it in HubSpot, ensuring data remains on-premise.

This approach allowed agents to reference sensitive data, such as validation or transactions, from the external source without the data being processed inside HubSpot and then never having to leave the contact’s timeline.

Make the most of HubSpot

What can a HubSpot Elite Partner Offer?

Explore the benefits of working with a HubSpot Elite partner. In this free white paper, we explore how to use HubSpot to gain a quicker return on investment and grow revenue.